Colonial First State shares insights into some of the key trends shaping the global economy.

With topics like digital disruption and population growth dominating the headlines, it can be difficult to know which global trends could have a real impact on you and your clients.

Things you should know: Count used reasonable efforts to ensure the commentary in this blog was accurate and true at the time that it was posted, but Count is not liable for any errors or omissions in the commentary. Since the time of posting it is possible that regulatory requirements and laws upon which the commentary were based have changed and the content is outdated. The commentary provided in this blog is informational only and while care was taken in the preparation of this blog, no liability is accepted by Count, its related entities, agents and employees for any loss arising from reliance on this blog. Any commentary regarding past economic performance is no indication of future performance and should be used as a general guide only.

To help understand the key ‘megatrends’ playing out globally, Colonial First State (CFS) recently developed the report, Global Trends: Potential Financial Services Impacts, which consolidates the research of thought-leading organisations around the world.

“The report includes insights from organisations such as the World Economic Forum, the United Nations, Bloomberg and The Economist Intelligence Unit,” said Gideon Lipman, Head of Strategic Projects and Business Delivery, CFS. “When we reviewed their research, we identified a number of megatrends that consistently emerged.”

CFS has classified these global megatrends into eight broad categories, ranging from healthcare and sustainability to technology and economic power.

“In financial services, it’s important to keep one eye on the longer term, and not just the day-to-day,” Lipman said. “This report encourages people to think broadly about the things that might impact their business over the next 3–5 years.”

Here are some of the megatrends that could play a role in shaping Australia’s financial advice landscape in the years ahead.

Tech threats?

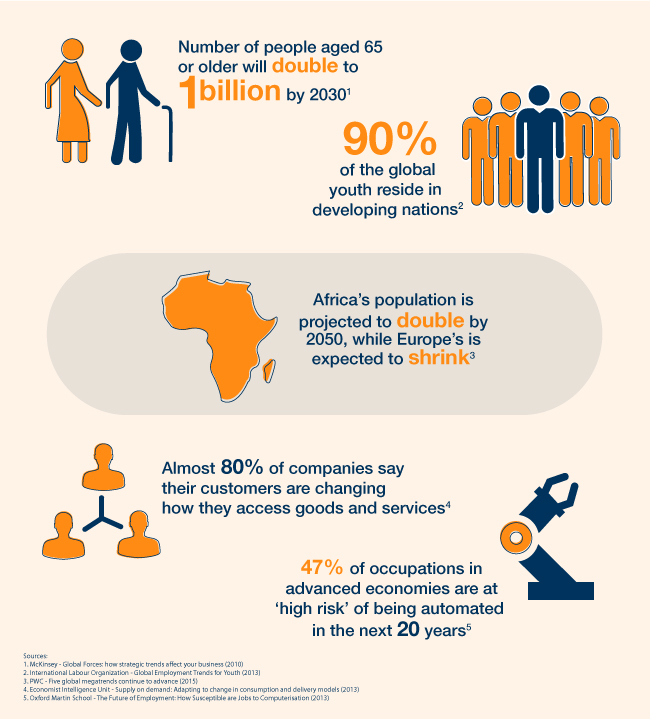

With new technologies driving automation across many industries, almost 80% of companies say customers are changing the ways in which they access their products and services.1 And according to the Global Trends report, almost half of the occupations currently being performed in advanced economies are likely to become fully automated in the next 20 years.

Within the advisory space, advances in robo-advice technology are causing particular concern for many advisers. However, forward-thinking firms around the world are starting to see robo-advice as an opportunity, rather than a threat. By harnessing the capabilities of robo-advice, advisers can boost efficiencies and improve customer service, while continuing to build strong relationships with their clients.

“Although robo-advice tools might be able to take on certain advisory tasks, people will continue to turn to advisers who they trust for financial guidance and coaching,” Lipman said. “The answer may lie in ‘bionic advice’ — a combination of robo-tools and adviser intervention — with advisers using this technology to add value to their business.”

Shifting demographics

In developed countries, the population is ageing — and the number of people aged 65 and older is set to double to 1 billion by 2030.2 Within the financial services industry, this signals a growing demand for retirement planning, aged care advice and estate planning. In turn, this presents opportunities for advisers to extend their client relationships through the provision of intergenerational advice.

However, while countries like Australia prepare for the challenges of an ageing population, this is balanced by a reverse trend in the developing world, where populations are getting younger. In fact, 90% of the world’s youth currently live in developing countries.

And in many African and Asian nations, where younger populations are taking advantage of technological advances and rising educational standards, the skilled and tech-savvy workforce is growing.3

“Accounting and financial advice businesses now have the chance to tap into skills overseas,” Lipman said. “Some firms are outsourcing administrative tasks, which allows them to focus more time and energy on their relationships with clients and the value they can deliver.”

A new regulatory playing field

Around the world, the rate of regulatory change is accelerating, as existing frameworks strive to keep pace with technological development and customer needs. Digital platforms have also driven greater customer advocacy across many industries, as individuals are now able to connect with other consumers across the globe.

Lipman commented: “Because of social media and communications technology, financial institutions and other companies worldwide are being held to higher standards of accountability by governments and the general public.”

As well as raising professional standards, regulatory change can also play a part in creating additional value for consumers. Lipman sees regulation as a two-way street — and believes as the regulatory landscape continues to evolve, financial services organisations will benefit from engaging with policy makers and regulators to drive outcomes which benefit customers and drive innovation.

“The key is to focus on the areas that really add value to our services,” he said. “The opportunity is there to have a say in what’s truly important to our customers.”

1 Economist Intelligence Unit, Supply on demand: Adapting to change in consumption and delivery models, 2013.

2 McKinsey, Global Forces: How strategic trends affect your business, 2010.

3 International Labour Organization, Global employment trends for youth, 2013.

This document has been developed by Count Financial Limited ABN 19 001 974 625, AFSL 227232 (Count Financial) in conjunction with Colonial First State Investments Limited ABN 98 002 348 352, AFSL232468 (Colonial First State) based on their understanding of current regulatory requirements and laws as at 13 June 2016. Both Count Financial Limited and Colonial First State are wholly-owned, non-guaranteed subsidiary of Commonwealth Bank Australia ABN 48 123 123 124. Count Wealth Accountants® is the business name of Count. Count advisers are authorised representatives of Count. This document is not advice and provides information only. It does not take into account your individual objectives, financial situation or needs. You should consider talking to a financial adviser, read the relevant Product Disclosure Statement available from the product issuer carefully and assess whether the information is appropriate for you before making an investment decision. Should you follow your Count adviser’s recommendation and take up product(s) issued by Colonial First State, your Count adviser may receive additional remuneration or commission from Colonial First State, and the advice provided may result in the benefit to the Commonwealth Bank Australia Group as a whole.