Dr George Beaton

Partner of Beaton Consulting

“Your best prospects are your existing clients” is a well-known marketing maxim.

Like all maxims, this one is based on generations of experience in the school of hard knocks. Beaton’s research of the last 10 years amongst the clients of Australia’s public accounting firms reveals there is a sound scientific basis for this truism.

Importantly, the research evidence shows what public accountants should be doing to improve and protect their relationships with clients.

You know a great deal about your clients – and they know you. So, by definition they are already warm. No cold-calling is required. And there’s no need to ask a third party to introduce you.

Things you should know: Count used reasonable efforts to ensure the commentary in this blog was accurate and true at the time that it was posted, but Count is not liable for any errors or omissions in the commentary. Since the time of posting it is possible that regulatory requirements and laws upon which the commentary were based have changed and the content is outdated. The commentary provided in this blog is informational only and while care was taken in the preparation of this blog, no liability is accepted by Count, its related entities, agents and employees for any loss arising from reliance on this blog. Any commentary regarding past economic performance is no indication of future performance and should be used as a general guide only.

What it takes to cross-sell

So, what’s the evidence of what it takes to cross-sell and grow your clients? By cross-sell, I mean invite clients to use all of the services your firm offers, not just the ones clients are currently buying. And by grow, I mean both grow with them as their businesses develop and expand, and grow your share of their external spend on accountants and consultants.

Let me explain.

First, you must deliver first class reliability, making it easy for your clients to do business with you, and on the commerciality of your advice, as I explained in an earlier Count Commentary post, The Art and Science of Marketing Public Accountancy Services.

These are the top three drivers of satisfaction among clients of public accounting firms. And these are also the drivers of your clients’ decisions to use your services again, and to say good things about you to business associates and friends, i.e. recommend you.

Second, you must help your clients ‘cross-buy’! Yes, clients prefer to cross-buy, making your task of cross-selling so much easier if you understand why this is so. Our research shows that clients have higher satisfaction with you when they use more of the service lines your firm provides.

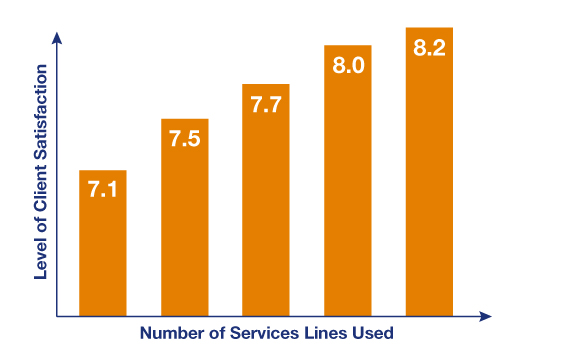

The accompanying chart shows that the greater the number of service lines a client uses in any one year, the higher their level of satisfaction. On a 0–10 scale the measured level of client satisfaction is shown on the vertical axis, and the number of service lines the respondent has used is shown on the horizontal axis.

Simply put, the more service lines a client uses, the happier they are.

Make the most of this finding

Normally we talk about cross-selling, that is informing your clients of the other services your firm offers. For example, if you are providing tax compliance and general business advice to a client and you introduce them to your SMSF or your mortgage broking services, then you think of this as ‘cross-selling’.

Why do clients like cross-buying? There are two reasons for using one supplier, rather than two or three:

- It reduces the client’s transaction costs; basically it’s easier and more convenient, saving the client time, and

- It gives the client more leverage over their services provider. In other words, it makes the client more important to the firm and provides the client with greater purchasing power.

There are also good reasons for you to maximise the number of services your clients each buy.

First, we know that if you manage your pricing and cost-to-serve effectively, you will make more profit from a client buying several services, compared to one buy a single service.

Second, by ‘hugging’ your clients in this way you discourage them from shopping around. You reduce the chances of them switching to another firm.

About the author

Dr George Beaton is a partner in Beaton, a firm specialising in research and advice for professional services firms in Australia and New Zealand.